Sea-Intelligence (Nov 27th, 2025) – 2025-Q3 Carrier Financials: Post-Peak Correction

- sarinratsiriratpir

- Nov 28, 2025

- 1 min read

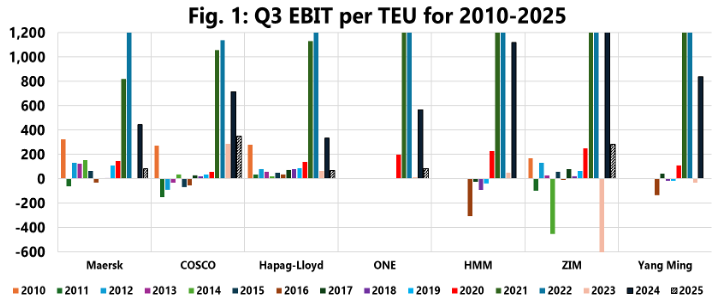

In issue 742 of the Sea-Intelligence Sunday Spotlight, we analysed the 2025-Q3 financial performance of the major global shipping lines. The results mark a correction from the disruption-fuelled highs of 2024, with the combined EBIT of the reporting carriers falling to USD 5.12bn – a sharp decline from the USD 17.06bn recorded in 2024-Q3. That said, despite the double-digit freight rate drops, the market floor has not fallen through; profitability remains well above the pre-pandemic levels of 2019, indicating that the market has settled into a sustainable “new normal.”

While financial results softened, operational data points to resilience. Global transported volumes grew for 6 of the 7 reporting carriers, suggesting that the influx of new vessel deliveries and reworked service networks have allowed shipping lines to absorb the longer Red Sea transit times without the panic-pricing seen last year.

Figure 1 illustrates the development in unit profitability (EBIT per TEU). COSCO recorded the highest EBIT/TEU in 2025-Q3 at 350 USD/TEU, followed by ZIM at 280 USD/TEU. These were the only two carriers to maintain unit profitability above 200 USD/TEU.

The remaining major carriers – ONE (85 USD/TEU), Maersk (83 USD/TEU), and Hapag-Lloyd (65 USD/TEU) – saw their margins compress significantly, dropping below the 100 USD/TEU mark. This stands in sharp contrast to the same period last year, where the lowest EBIT/TEU in this group was 335 USD/TEU, highlighting the extent of the post-peak market correction.

--- 000 --- END OF PRESS RELEASE --- 000 ---

All quotes can be attributed to: Alan Murphy, CEO, Sea-Intelligence.

Comments